Office Supplies Income Statement . the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. supplies expense refers to the cost of consumables used during a reporting period. When classifying supplies, you’ll need to. like any other expense, a company must account for its supply costs on the income statement. how to classify office supplies, office expenses, and office equipment on financial statements. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. They can be categorized as factory. Once companies decide to expense out. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. what are the journal entries for accounting materials and office supplies?

from www.principlesofaccounting.com

supplies expense refers to the cost of consumables used during a reporting period. When classifying supplies, you’ll need to. the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. what are the journal entries for accounting materials and office supplies? like any other expense, a company must account for its supply costs on the income statement. how to classify office supplies, office expenses, and office equipment on financial statements. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. Once companies decide to expense out. They can be categorized as factory.

Statement Enhancements

Office Supplies Income Statement Once companies decide to expense out. what are the journal entries for accounting materials and office supplies? They can be categorized as factory. Once companies decide to expense out. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. When classifying supplies, you’ll need to. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. like any other expense, a company must account for its supply costs on the income statement. how to classify office supplies, office expenses, and office equipment on financial statements. supplies expense refers to the cost of consumables used during a reporting period. the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies.

From www.myaccountingcourse.com

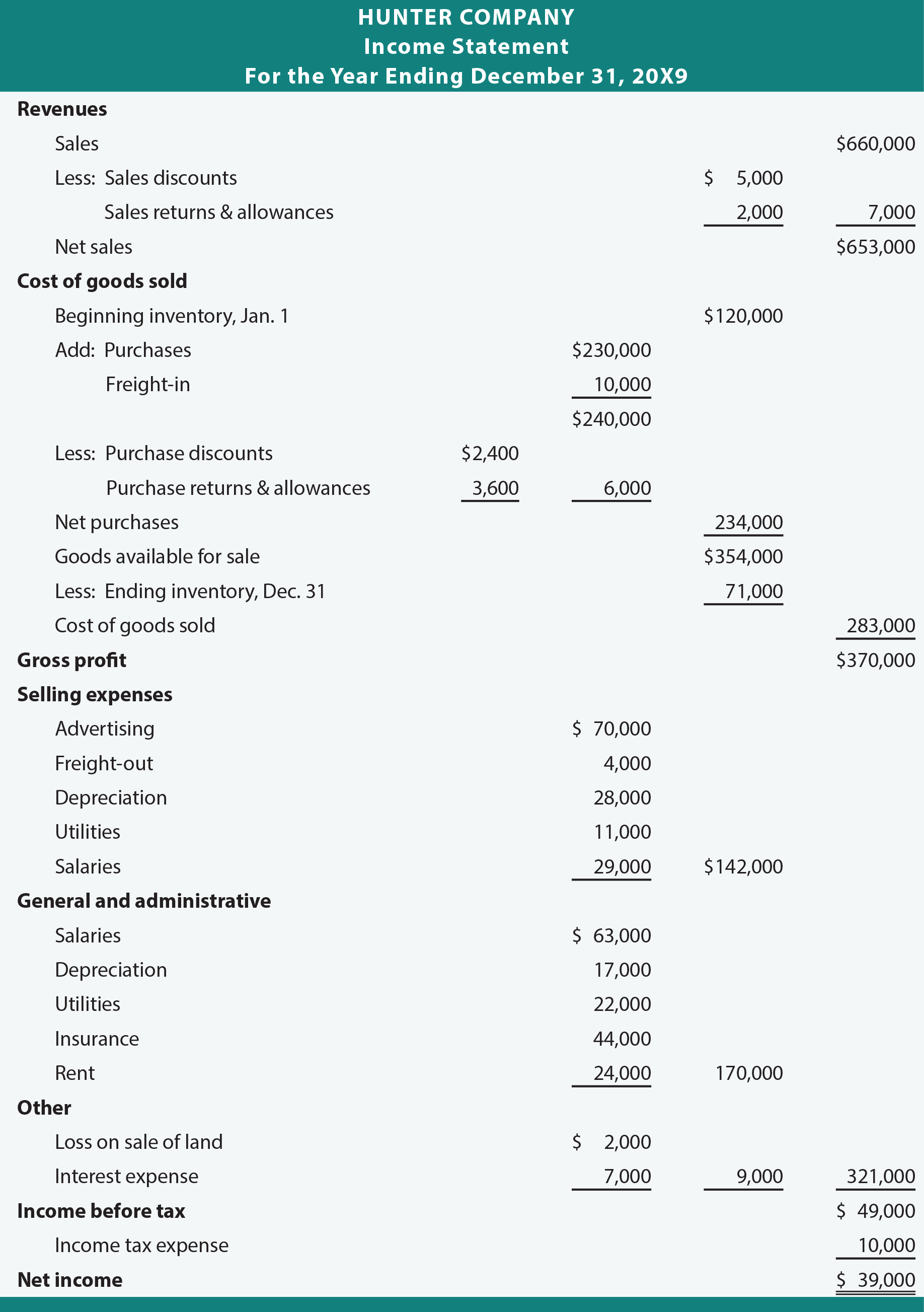

Multi Step Statement Example Template Explanation Office Supplies Income Statement When classifying supplies, you’ll need to. supplies expense refers to the cost of consumables used during a reporting period. like any other expense, a company must account for its supply costs on the income statement. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. how to classify office. Office Supplies Income Statement.

From www.investopedia.com

Statement Definition Uses & Examples Office Supplies Income Statement Once companies decide to expense out. They can be categorized as factory. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. like any other expense, a company must account for its supply costs on the income statement. When. Office Supplies Income Statement.

From www.enkel.ca

Statements for Business Owners Enkel BackOffice Solutions Office Supplies Income Statement like any other expense, a company must account for its supply costs on the income statement. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. Once companies decide to expense out. When classifying supplies, you’ll need to. the cost of office supplies on hand at the end of an. Office Supplies Income Statement.

From www.fool.com

A Small Business Guide to the Statement The Blueprint Office Supplies Income Statement how to classify office supplies, office expenses, and office equipment on financial statements. what are the journal entries for accounting materials and office supplies? the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. They can be categorized as factory. When. Office Supplies Income Statement.

From www.sampletemplates.com

FREE 11+ Pro Forma Statement Templates in PDF MS Word Office Supplies Income Statement When classifying supplies, you’ll need to. like any other expense, a company must account for its supply costs on the income statement. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. Once companies decide to expense out. . Office Supplies Income Statement.

From www.shopify.com

An Statement That Works for Your Business — Backoffice (2022 Office Supplies Income Statement the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. When classifying supplies, you’ll need to. what are the journal entries for accounting materials and office supplies? Once companies decide to expense out. supplies expense refers to the cost of consumables. Office Supplies Income Statement.

From www.principlesofaccounting.com

Statement Enhancements Office Supplies Income Statement how to classify office supplies, office expenses, and office equipment on financial statements. in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. the cost of office supplies on hand at the end of an accounting period should. Office Supplies Income Statement.

From lonewolf.my.site.com

Generate a MultiOffice statement (Back Office) Office Supplies Income Statement the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. how to classify office supplies, office expenses, and office equipment on financial statements. Once companies decide to expense out. in the case of office supplies, if the supplies purchased are insignificant. Office Supplies Income Statement.

From warnkebaccumare.blogspot.com

Statement From Continuing Operations Examples Warnke Baccumare Office Supplies Income Statement the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. how to classify office supplies, office expenses, and office equipment on financial statements. They can be categorized as factory. Once companies decide to expense out. supplies expense refers to the cost. Office Supplies Income Statement.

From templatelab.com

41 FREE Statement Templates & Examples TemplateLab Office Supplies Income Statement They can be categorized as factory. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. like any other expense, a company must account for its supply costs on the income statement. When classifying supplies, you’ll need to. supplies expense refers to the cost of consumables used during a reporting. Office Supplies Income Statement.

From www.dexform.com

statement template in Word and Pdf formats Office Supplies Income Statement in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. They can be categorized as factory. supplies expense refers to the cost of consumables used during a reporting period. like any other expense, a company must account for. Office Supplies Income Statement.

From www.chegg.com

Solved QS 417 (Algo) Preparing a multiplestep Office Supplies Income Statement what are the journal entries for accounting materials and office supplies? in the case of office supplies, if the supplies purchased are insignificant and don’t need to be classified as a current asset, you can simply debit the supplies as. They can be categorized as factory. supplies expense refers to the cost of consumables used during a. Office Supplies Income Statement.

From accountinguide.com

Statement The three elements and example Accountinguide Office Supplies Income Statement They can be categorized as factory. the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. what are the journal entries for accounting materials and office supplies? how to classify office supplies, office expenses, and office equipment on financial statements. . Office Supplies Income Statement.

From templatelab.com

41 FREE Statement Templates & Examples TemplateLab Office Supplies Income Statement supplies expense refers to the cost of consumables used during a reporting period. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. When classifying supplies, you’ll need to. the cost of office supplies on hand at the end of an accounting period should be the balance in a current. Office Supplies Income Statement.

From www.coursehero.com

[Solved] Please show work. PR 65A Multiplestep statement and Office Supplies Income Statement the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. in the case of office supplies, if the supplies purchased are insignificant and don’t. Office Supplies Income Statement.

From www.myaccountingcourse.com

What is Selling, General & Administrative Expense (SG&A)? Definition Office Supplies Income Statement like any other expense, a company must account for its supply costs on the income statement. supplies expense refers to the cost of consumables used during a reporting period. an income statement demonstrates how profitable or unprofitable your business has been over the course of a. in the case of office supplies, if the supplies purchased. Office Supplies Income Statement.

From www.slideteam.net

Office Supplies Statement Ppt Powerpoint Presentation File Office Supplies Income Statement an income statement demonstrates how profitable or unprofitable your business has been over the course of a. the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as supplies. like any other expense, a company must account for its supply costs on the. Office Supplies Income Statement.

From www.wordtemplatesonline.net

How to Prepare an Statement (5+ Free Templates) Office Supplies Income Statement When classifying supplies, you’ll need to. supplies expense refers to the cost of consumables used during a reporting period. like any other expense, a company must account for its supply costs on the income statement. the cost of office supplies on hand at the end of an accounting period should be the balance in a current asset. Office Supplies Income Statement.